TT.PFM: Portfoliomanagement - Flexibel & verständlich

Run your portfolio management within INIPRO - quickly, flexibly and with exactly the functions you need.

The portfolio management module for INIPRO

With our portfolio management module for INIPRO, you can now plan, manage and securely store your different schedule deliveries.

Whether for energy suppliers, energy consultants or energy-intensive companies: The professional portfolio management of timpetools catapults your procurement to the latest technical level. Energy trading has never been so efficient!

Three reasons for TT.PFM

1.

Flexible

All schedules, actual or forecast time series as well as forward and spot market transactions can be managed in TT.PFM. Not overloaded with options and yet extremely flexible. You determine what should happen. TT.PFM supports you, but does not impose any processes on you.

2.

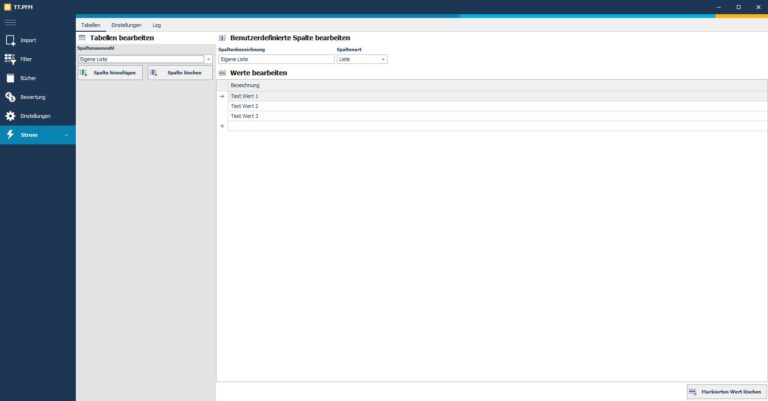

Own variable fields

Are you missing fields in the master data? No problem. You can freely define up to 20 fields and also create lists, dates, numbers or text fields. This means that even unusual master data should find its way into the TT.PFM database without any problems.

3.

Master data

The fields available in the standard for describing an electricity or gas time series or a transaction enable you to categorise all imports in a very differentiated way. Master data for any number of time series can be assigned both directly during import and subsequently.

Explanation of terms

Time series

A time series is the smallest quantity that can be stored in TT.PFM. This can be an electricity or gas schedule, but also a base or peak procurement.

Filter

It is possible to combine several time series via various filters, e.g. the procurement for a customer, or its day-ahead adjustments, or its sales.

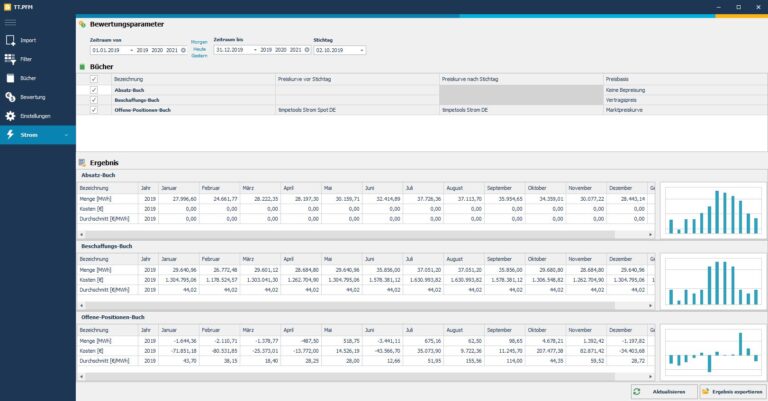

Books

A book always consists of at least one filter, but can also be the calculated result of several filters. Books are the basis for month-differentiated evaluations, financially and in terms of quantity, in tabular form and as graphics.

Have we aroused your interest in TT.PFM?

What features does TT.PFM offer?

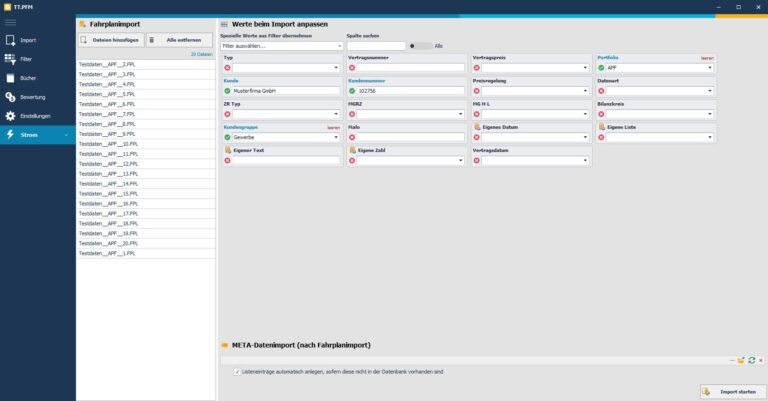

Import/Export

Data exchange with the INIPRO base system is extremely simple. Time series in INIPRO are available as files. You select them and move them with one click to TT.PFM, which opens automatically. Here you determine the master data and start the import. Or you import everything first and later determine which master data you want to assign to the new data. If there is a lot of data, there is an interface file on a CSV basis in which you can specify the imports. Exporting is just as easy. Select the time series or book, right-click and export for INIPRO. Afterwards, you can use all the usual functions in INIPRO for further evaluation and analysis. All valuations from TT.PFM can of course also be exported in Excel format.

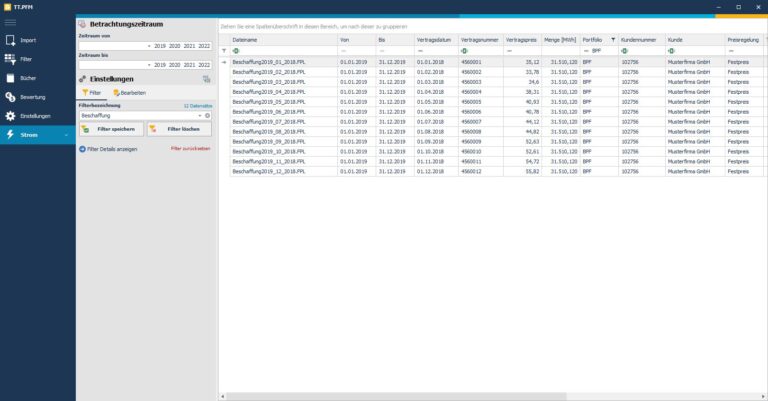

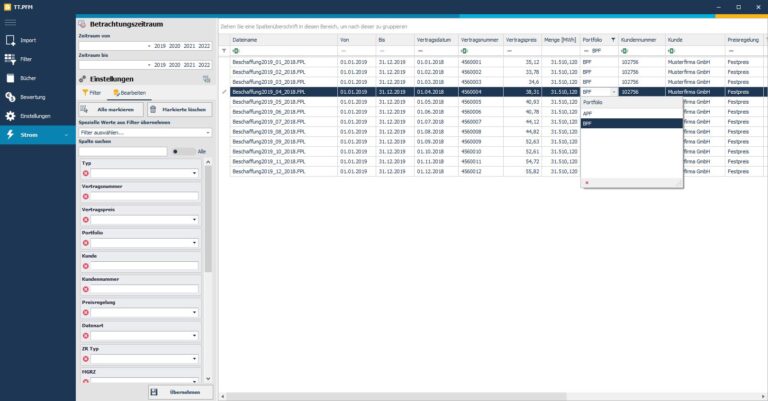

Filter

You can use filters, but you don't have to. Without filters, however, TT.PFM loses its appeal. Only when you also manage CRM-related information does TT.PFM unfold its true strengths. The many master data such as contract date, contract number, delivery period, portfolio affiliation, SLP/RLM, customer, customer number, price regulation, contract price and the up to 20 variable fields enable you to form any groups you want, which you can save and address via filters. Filters are then the basis for creating books. A filter can summarise one or more time series as a total.

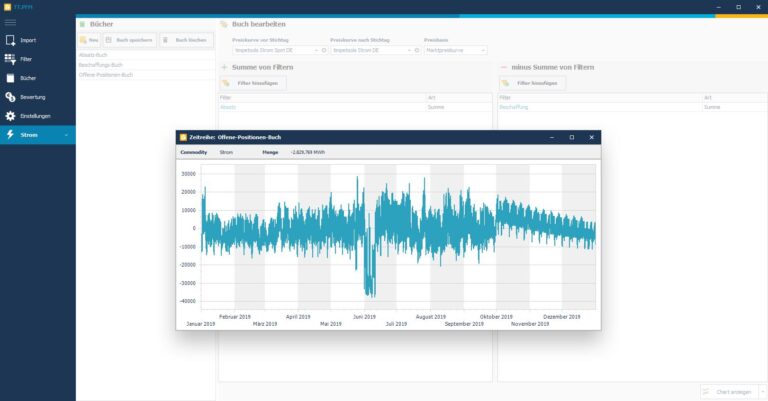

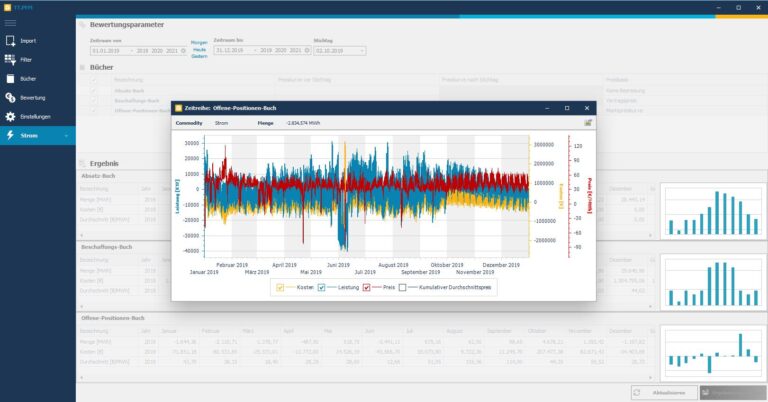

Books

In portfolio management, one works with books. A book consists of at least one filter and thus at least one time series. In the same way, however, the procurement book of a customer can contain the addition of the filters customer1_forward market procurement and customer1_spot market procurement. The book for the open quantities would then be the addition of all procurement filters minus the filters for the sales forecast, e.g. customer1_sales_long-term + customer1_sales_medium-term + customer1_sales_short-term. The book result can be viewed graphically at any time or exported to INIPRO for further analysis.

Rating

The goal of portfolio management is to determine quantities to be procured, to monitor the price of the procurements and to control the development of the portfolio in such a way that the portfolio result makes a positive contribution to the business result despite all risks for the spot market and balancing energy. For this purpose, you can have the defined books evaluated. If your period to be considered, e.g. from the book of open quantities, is in the future, then the valuation can be carried out with a current market price curve. If you have your own price curve, then you can use your price curve, otherwise use the price curve from timpetools. In the past, the valuation can be based on spot market prices. This price curve can also be provided by timpetools. For procurements, the valuation should be based on the contract prices. Everything is output in a month-differentiated tabular form or as a zoomable graphic. This way you always have your portfolio result in view!

Further information

Would you like to receive more information about our products? Then send us your enquiry via the contact form. We will be happy to send you further information material or present our solutions at your premises.

These products might also interest you

Energy sales for

Business customers

Sales for individual business customers in the EMDaCS price portal. Automated. Simple. Trustworthy. Secure.

Market price analysis for

business customers.

Transparent market prices for own load profiles with price ticker and price history.Energy procurement simple and secure.

The Swiss Knife for

the Energy Industry

Die intuitive und preiswerte Möglichkeit zur Prognose, Analyse, Kalkulation sowie Zerlegung von Strom- und Gasfahrplänen.

The intuitive

weather data portal

Use all historical and current weather data of the German Weather Service integrated in INIPRO for your forecast.

Market price curves

for electricity and gas

Keep an overview: with daily updated and intraday market price curves for electricity and gas directly in INIPRO.